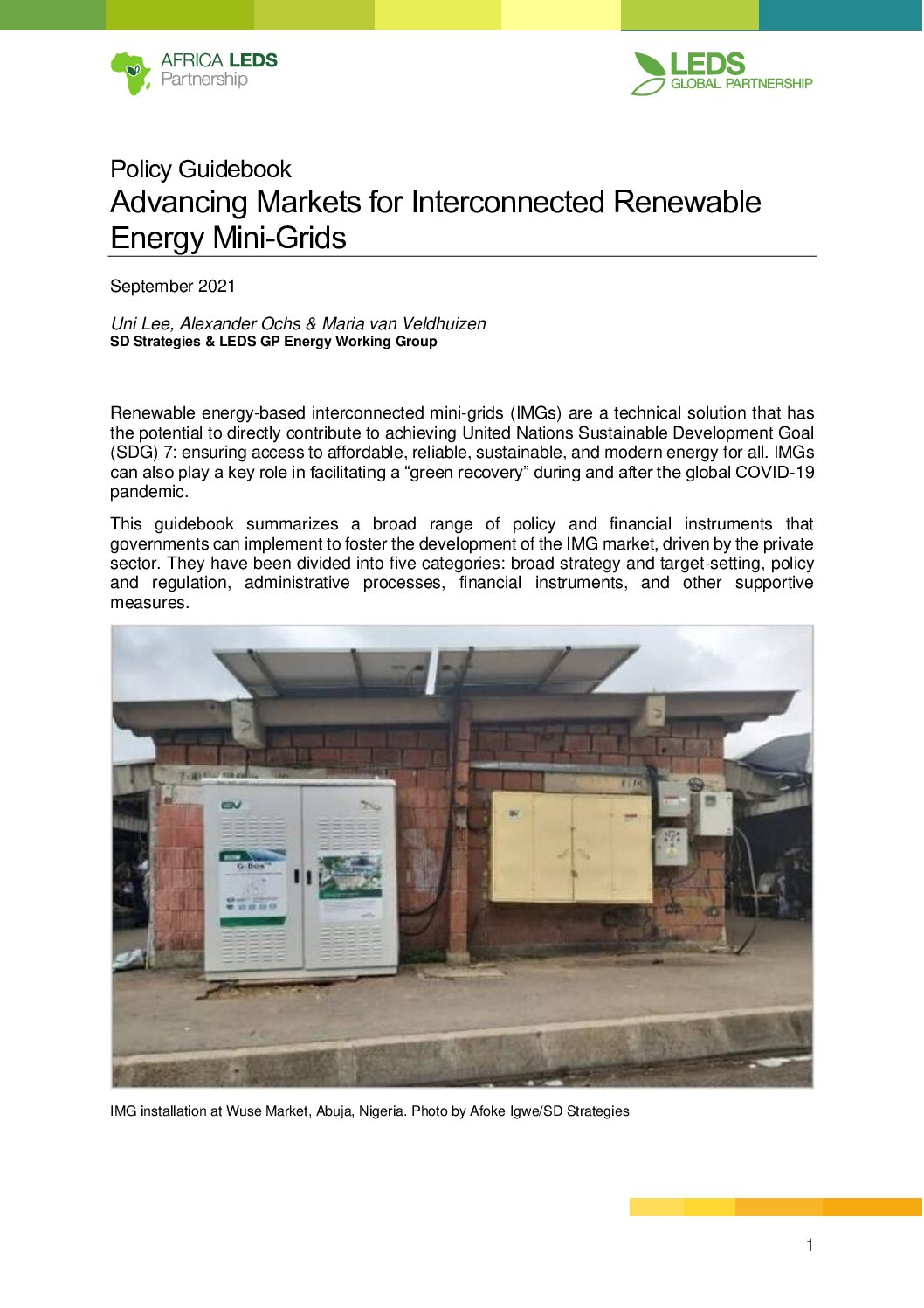

This guidebook summarizes a broad range of policy and financial instruments that governments can implement to foster the development of the interconnected mini-grid market, driven by the private sector.

This slide deck provides a quick overview of the process for the development of energy projects by indigenous groups, including tips on choosing an optimal site, ownership structures and financing structures.

This web page provides a detailed overview of the key elements of a renewable energy business plan/project proposal.

This report identifies the main risks and barriers limiting investment in the energy transition, supplying a toolkit for policy makers, public and private investors, and public finance institutions to scale up their investments in renewable energy.

This guide provides an overview of aspects to consider in the development and financing of a renewable energy project, both for public of private promoters and investors. English: https://www.ecoserveis.net/wp-content/uploads/2021/05/Guide-to-Financing-of-Sustainable-Energy-Projects-2nd-edition.pdf Spanish: https://www.ecoserveis.net/wp-content/uploads/2019/04/guia-para-la-financiacion-de-proyectos-de-energia-sostenible-2a-edicion.pdf

This handbook examines financing mechanisms suitable for the renewable energy access sector in Madagascar, and provides advice on preparing financing applications.

This article assesses the opportunities provided by digital monitoring, reporting and verification (dMRV), which can facilitate real-time tracking of the use and fuel sales from clean cooking products, thereby increasing the integrity of emissions reduction claims.

This database provides different dashboards presenting data on the latest investment and operational trends in clean cooking, including carbon market data and customer perceptions of clean cooking companies’ products and services.

This page presents the Principles for Responsible Carbon Finance in Clean Cooking, developed by the CCA.

This report illustrates the need for digital monitoring, reporting, and verification (D-MRV) systems to underpin future carbon markets. It discusses the available technologies, and barriers to their adoption, as well as guidelines, tools, and lessons learned to promote the use of these systems.