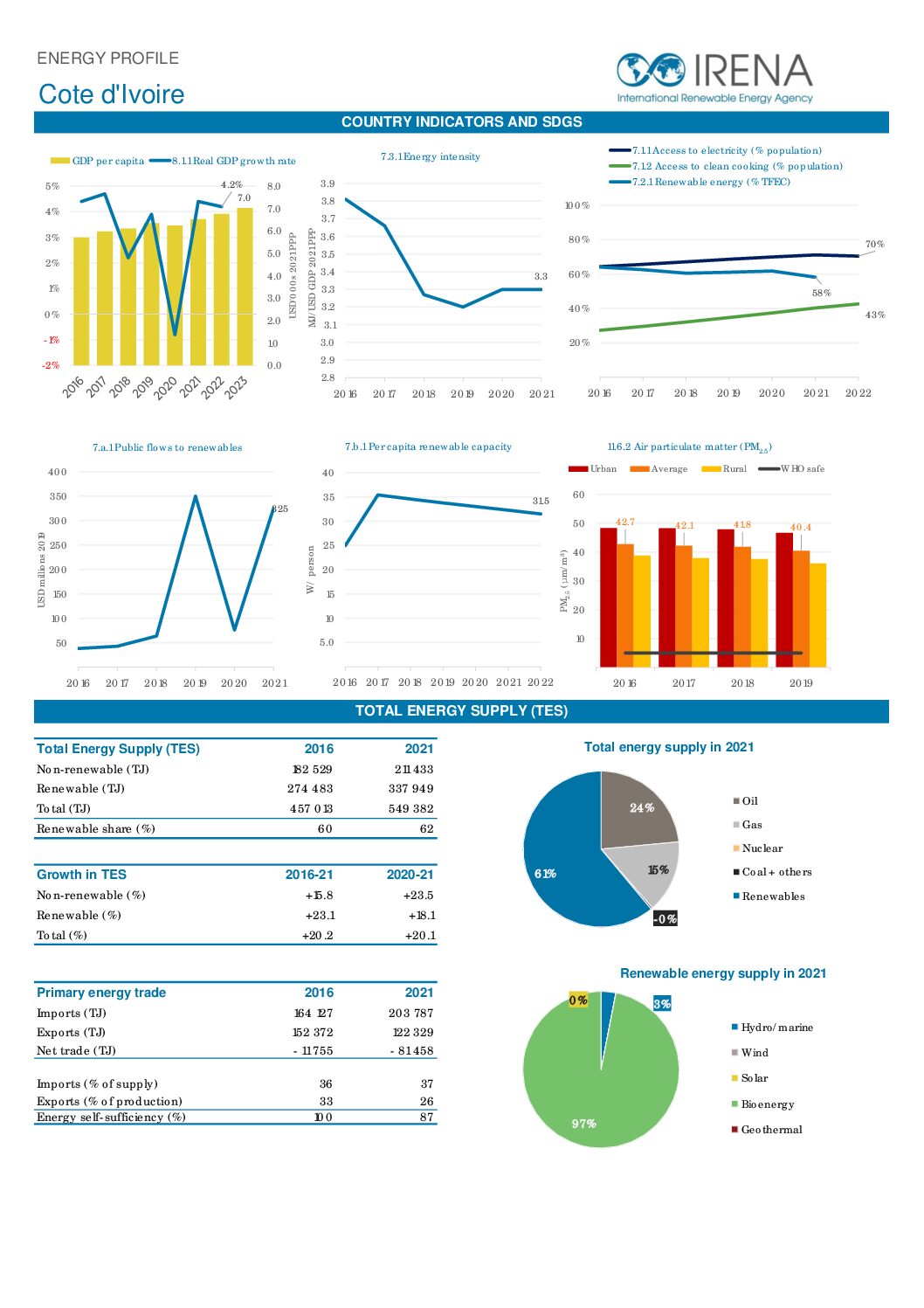

This energy profile provides recent data on the energy sector of Côte d’Ivoire, including generation mix,total generation, renewable energy potential and more.

This report assesses the progress of the energy transition in the Dominican Republic and identifies future pathways.

This guide aims to help energy statisticians understand the various elements and processes involved in renewable energy data collection and management, and identify capacity gaps. It covers seven requirements for effective data management: 1. Legal and institutional frameworks; 2. Well-defined data requirements; 3. Sufficient skilled personnel; 4. Clear methodologies and processes; 5. Appropriate data collection […]

Institutions all over the world are setting up microcredentials in responses to calls from governments and industry: short courses, usually offered online by accredited institutions, with an emphasis on the needs of the workplace. They are also often used for retraining and upskilling. This book explains how to start offering microcredentials as an academic institution.

This guide aims to accelerate the flexibility and responsiveness of learning systems by providing guidance on the design, issue and recognition of micro-credentials.

The is comprehensive course is intended for energy statisticians working at national statistical offices and ministries in charge of energy.

A course on energy subsidies, their costs, and the design of a successful reform based on country case studies.

This chapter provides an overview of energy tax and subsidy patterns in the 71 countries covered in the report and estimates the net effect of energy taxes and subsidies on public finances.

This edition of the Investment Policy Monitor assesses the global landscape of fossil fuel subsidies and promotion of investment in the energy transition.

This paper investigates the role of carbon taxes in the energy transition, with case studies from Chile, Ghana, Indonesia and Jamaica.