This paper discusses the role of AI in the energy transition in Latin America, identifies key factors for successful implementation in the region and proposes an AI maturity model for the energy transition that allows stakeholders to assess the status and gaps for the AI adoption.

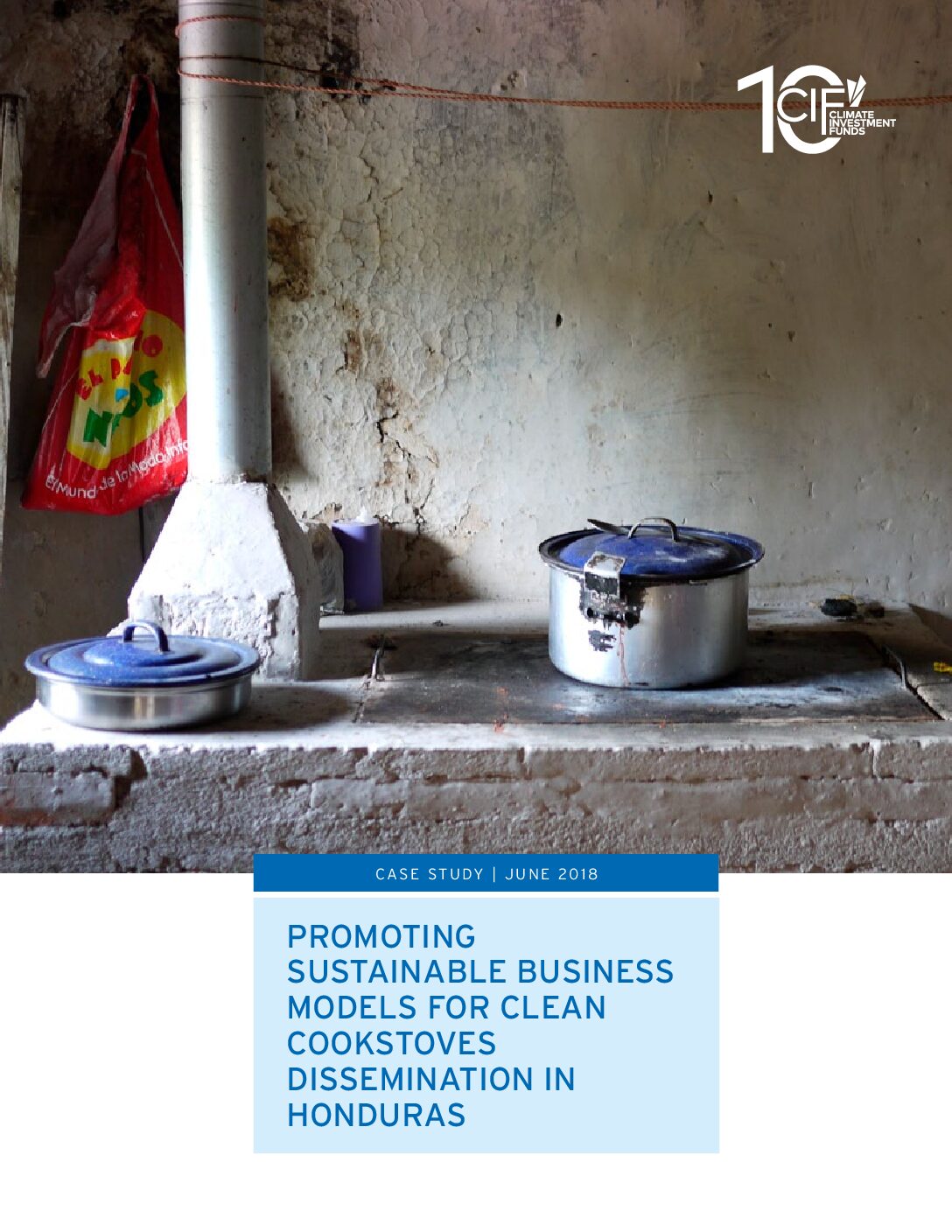

This brief presents lessons learned from ten case studies on successful business models for clean cooking solutions.

This database provides different dashboards presenting data on the latest investment and operational trends in clean cooking, including carbon market data and customer perceptions of clean cooking companies’ products and services.

This page presents the Principles for Responsible Carbon Finance in Clean Cooking, developed by the CCA.

This article assesses the opportunities provided by digital monitoring, reporting and verification (dMRV), which can facilitate real-time tracking of the use and fuel sales from clean cooking products, thereby increasing the integrity of emissions reduction claims.

This case study describes how the PROFOGONES project managed to establish the foundations of a sustainable, demand-driven cookstove market in Honduras.

This blog assesses the opportunities of carbon finance to fill financing gaps for clean cooking, and highlights the integrity, reputational and regulatory risks associated with the sale of carbon credits.

This report illustrates the need for digital monitoring, reporting, and verification (D-MRV) systems to underpin future carbon markets. It discusses the available technologies, and barriers to their adoption, as well as guidelines, tools, and lessons learned to promote the use of these systems.

This report takes stock of the status of the voluntary carbon market for clean cooking, and identifies current trends influencing its likely direction in the next five years.

This report highlights evdience on key unit economics drivers for clean cooking, with the aim to better articulate the value of clean cooking, reduce transaction costs, support actors across the ecosystem to capitalize on commercial and impact opportunities, and ultimately unlock more investment capital for the sector.